Chapter 5

Online Banking

What is online banking?

Online banking is a virtual bank branch on the Internet, where you can carry out and receive most of the operations and services you would expect from a physical bank. Online banking allows you to make transfers with your computer or smartphone, for example, and manage and control your accounts regardless of opening hours.

How online banking works

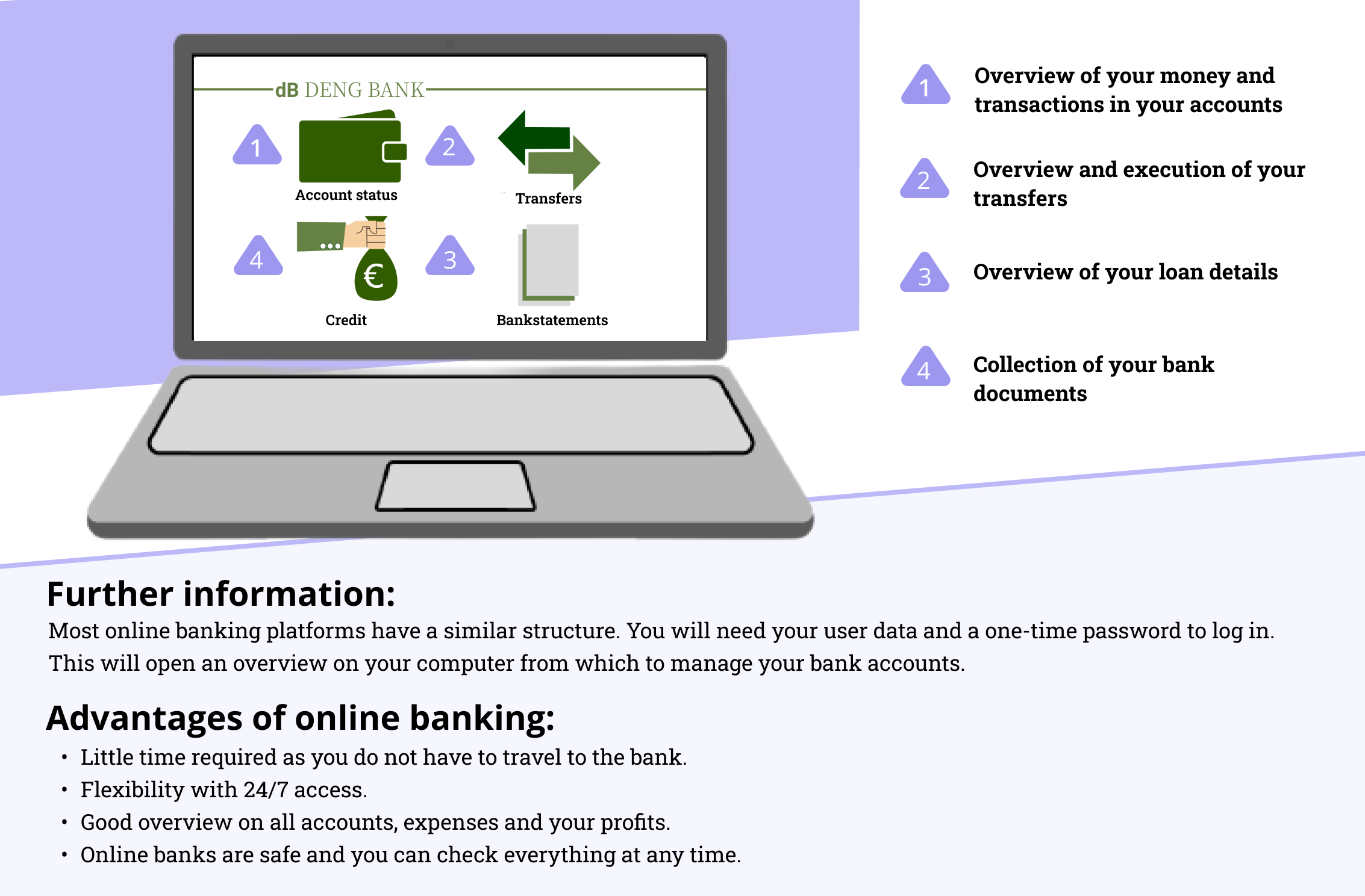

Most online banking platforms have a similar structure. In order to log in to your bank’s online banking platform, you will need your user details (username + password) and a one-time password, which you will receive via your LuxTrust product (see Chapter 3: LuxTrust App, SmartCard or Scan). This will open an overview on your computer with several choices for managing your bank accounts:

- Financial Status: An overview of the funds in your bank accounts and on your credit cards. Additionally, you can view your account movements: which amounts have been transferred to your account and which have been transferred from your account to another account.

- Transfers: In addition to an overview of all incoming and outgoing transfers, you can also make new transfers and set up standing orders (these are monthly transfers that are transferred automatically).

- Credit: If you have a current loan with your bank, you can see all the details here. These include, first, the total amount and the term of the loan, the amount that has already been paid and how much still needs to be paid.

- Bank documents: In this section, you can consult your bank documents at any time. For example: you can review your bank statements or create a banking certificate.

- Other services: Most online banking platforms offer many more services. These include, but are not limited to, the ability to request an appointment online at a bank branch, a new credit card, a credit card block, or a temporary loan. Many banks also offer virtual assistants on their platforms who can give you useful advice on your questions.

Advantages of online banking

- Higher speed: Online banking saves you time because you don’t have to drive to the bank.

- Flexibility with 24/7 access: Online banks are always open, regardless of the bank’s opening hours.

- Good overview of all accounts: You keep a better overview of your income and of your expenses, as the information is available online at all times.

- Better control and security: Online banks are secure, and you can check anything at any time. This allows you to quickly see if something is wrong with on your account.

Try out online banking in our secure test environment: E-Banking Learning Tool

Training tasks

[[ question ]]

Everything is correct!

You did not select all the correct answers, the correct one would have been:

[[ answer.value ]],

[[ answer.value ]],

Your answer contains errors, the correct answer would have been:

[[ answer.value ]],

[[ answer.value ]],

Summary: Online Banking